Your KYC, Tokenised

Secure, reusable, and user-owned.

One verified identity for banks, insurers and financial services — consent-driven, privacy-preserving, and instantly verifiable.

Key Problems We Solve

Traditional KYC is broken. We're fixing it with tokenised, verifiable credentials.

How It Works

Three simple steps to tokenised, reusable identity

Issue KYC

Banks verify identity and issue a verifiable KYC credential.

User holds token in Wallet

Users store credentials securely and share with consent.

Reuse & Verify

Verifiers confirm authenticity instantly without re-verification.

Features & Capabilities

Enterprise-grade identity infrastructure built on open standards

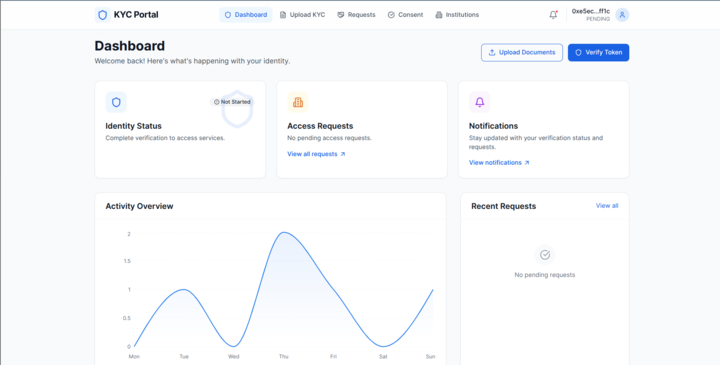

Dashboards & Roles

Purpose-built interfaces for every stakeholder

Security & Compliance

Enterprise-grade security built into every layer

KMS/HSM for Keys

Hardware security modules protect cryptographic keys

DPDP-Compliant

Designed for data protection and privacy regulations

Audit Logs

Comprehensive logging for compliance and forensics

Consent Receipts

Transparent records of user consent and data sharing

Encryption at Rest

All data encrypted using industry-standard algorithms

Encryption in Transit

TLS 1.3 for all network communications